I’m not an stock analyst but I do like to trade and my specialty is tech. Specifically, trends in the industry and I think Amazon (AMZN) is trending for three reasons: warehouses, cloud, and e-books.

Amazon’s core business model is to dominate the 174 billion dollar e-commerce industry. The growth for which is incredible, a rate of 15% per year with plenty of space for growth; e-commerce is only 4.5% of retail commerce (pdf).

Definitely a good situation to be in, but with so much money to be made the powerhouses, like Walmart, Target, and Best Buy, want in. In response Amazon is making an agressive move with what I call, warehousing.

The official title of this program is Fulfillment by Amazon, which I think is a cagey way of understating their moves. They don’t want to alert the competition. The program involves Amazon building huge warehouses to store and ship goods. At first it was just to sell their own goods but it has since expanded to every seller.

Now anyone can list their products on the site and send them to an Amazon warehouse. The retailer will hold them until they sell then quickly package and ship.

It’s working really well. It makes selling even more easier, which is hard because I think Amazon has the best/easiest model for selling goods on the web. It just invites more and more to join and continually expands Amazon’s offerings. This increases the fees they get for each sale and corners the market (eating Ebay‘s lunch). It’s working so well that big box retailer, Target, is selling on Amazon, in essence forcing others to partner with Amazon rather than compete.

On a side note, is gives Amazon a small risk. In good times they ship and sell, while working hard to be an efficient warehouse that keep costs down on packaging and shipping. In bad times they could be left with large staffs, full warehouses, and bleeding money. Definitely, something to think about.

That risk requires Amazon to be agressive and keep on selling, which is exactly where they need to be (hungry). Which is exactly what I look for in a company to invest in.

Amazon’s Web Service

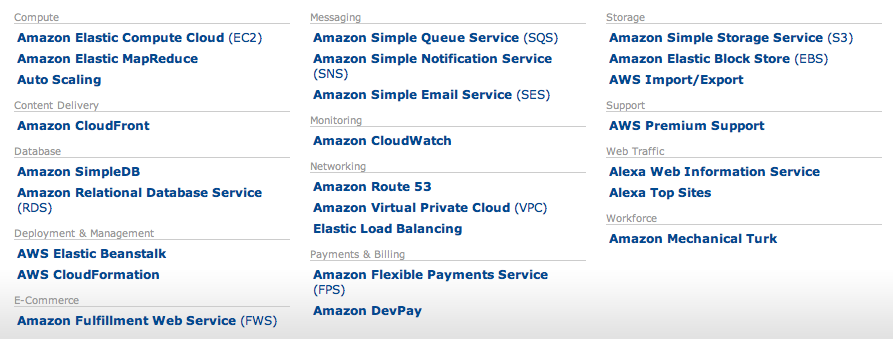

Now lets switch to another focus, the cloud. A popular topic these days and everyone is making a play. But all the plays are for cloud applications. Not Amazon, they are building real estate that the applications will run on. The program is called Amazon Web Service (AWS).

Through investments of 100s of millions that have baffled Wall Street they have created incredible economies of scale. Like server capacity for $0.12/hour and storage for $0.12/GB. Offerings so cheap they are irresistible. It’s a play to undercut everyone on the market and it’s working. No one else on the market can compete and if they wanted to it would take years to build.

To which the common stock market analyst quips; there’s not much money in $2.99/ month hosting fees. True enough but if you add up several million of those and combine it with a rapidly growing personal website market it changes the story. Remember, in the future everyone will have their own website and they will be paying someone to host it.

I’m barely touching the surface too. Corporations, all of them, are going to need computing power. They can build it themselves (and many will) but a large majority will outsource it. A billion dollar market and Amazon will dominate that as well.

Take a look at their product listing, it’s impressive:

This is kind of like buying Manhattan Island before the settlers arrive and then renting out each acre. It’s an endless supply of money.

E-Books

I saved e-books for last because the topic so popular that everything tends to get ignored. In a nutshell, Amazon made its bones as an online bookstore but that industry (paper books) is on the decline. You can buy nearly any book for a couple of dollars and that means very low fees for Amazon to profit on.

In response they created the Kindle to spark the e-book industry and got lucky. The Kindle hit at a time when, really, no one else was competing in the e-book market. Add in that, thanks to the iPhone, app stores are the key to building the market. To which Amazon responded perfectly. Their push to get every book they can on the Kindle is legendary and the fights have been fun.

Now millions of books are available on the Kindle and it is bringing in billions for them. Some reports say it is now 10% of their sales and generating $5+ billion in revenue. Great numbers but what is more important is that Amazon took its primary business, reinvented it, created a hugely profitable industry, and is dominating it.

Add up all three of these major moves and I think Amazon is well positioned for the future.

Next I will make my first attempt to gauge the P/E earnings on the stock and determine my own target price for the stock!

how does the recent outage in Amazon’s cloud service impact your analysis? that seems like quite a PR blunder to recover from…

http://venturebeat.com/2011/04/23/amazons-outage-in-third-day-debate-over-cloud-computings-future-begins/

That’s a good question. I wonder if any companies will stop using the service as a result…

I figure that this is why they say 99% uptime. You know like it only goes down once in a few years and so they can maintain that number.

This may not be a suitable place to ask this, but, I need the services of a independant financial advisor in Leicester and I can’t figure out where to look. Do you have any information on this financial advisor. He is based in Leicester near to my business.I can’t find any reviews on them…..Santorini Financial Planning Ltd 19 Strathern Road, Leicester LE3 9QA 0116 235 5733