I’ve been a big fan of Square from the beginning, mostly because I hate the cashier’s line. I even gave a talk at Ignite DC called, “The Future of the Queue”, though I spent all my time bashing the very old, and expensive technology that cashier’s use:

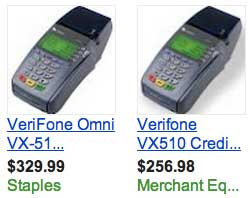

Lol, $300+ dollars just to read a credit card! Did you know that Square gives away this technology for free?

I repeat “gives it away for free.” It’s no wonder that the company is rumored to be valued at $3.2 billion.

How do they make their money, through fees, of course. From Square:

Transparent Pricing

- 2.75% per swipe.

- Free app, free Square Card Reader and free shipping.

- No merchant account, monthly fees or set-up costs.

Next-Day Deposits

- Payments in your bank account the next business day

- Payments automatically sent for deposit to your bank with email confirmations.

- No limit to the number or amount of payments you can take.

I’ve done some small business transactions and I know that these fees are big business. If you think about skimming off nearly 3% from every credit transaction we are talking about billions of dollars. In 2006, a study found that we spend nearly $1 trillion on credit each year (pdf).

That may explain why Starbucks, a coffee company, is playing venture capital by investing in Square. Though, many are speculating that the reason is to improve the “Starbucks experience” which I guess means giving baristas iPads and smartphones like the Apple Genius have.

It’s possible, but I’m very skeptical, it’s more likely that Starbucks is looking to cut back-end costs associated with credit transactions and that is something Square does very well. A few pennies per transaction is a lot of money for the big corporation.

Not to mention that Starbucks already has a strong mobile payment solution that “about 1 million people a week are using” out of 60 million transactions a week.

It’s definitely an interesting story and one that spells big changes for the payments industry. Some good articles on this topic:

- @GigaOm – So this really explains a lot about that rumored $3.2 billion valuation

- Square Partners With Starbucks; Howard Schultz Joins The Board

- A breakfast with Square and Starbucks: CEOs explain their unique partnership