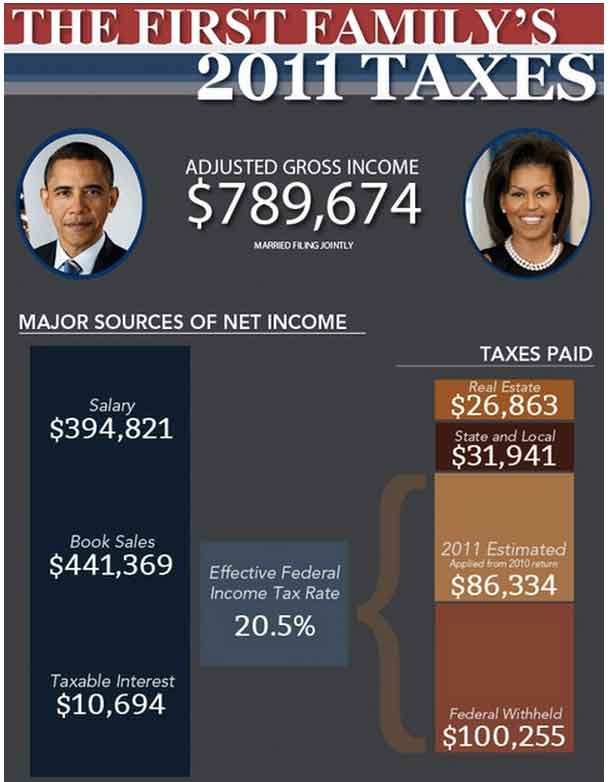

As we all get finished with our taxes so do the President and First Lady. It turns out that the Obama’s came in with a 20.5% tax rate on income of $789,674 (married filing jointly), including donations worth $172,130.

The bulk of that income came from presidential salaries, $394,821, and book sales, $441,369.

In 2010, their income was $1.7 million with the increase due to book sales, and in 2009, it was more than $5.5 million from book sales and Barack’s Nobel Peace Prize award money.

In comparison, Mitt Romney pulled in an estimated $20.9 million in 2011, and is paying a %15.3 tax rate on that. It seems that both our politicians are paying lower rates than average Americans.

Some other facts:

- The Obamas paid $162,074 in total tax.

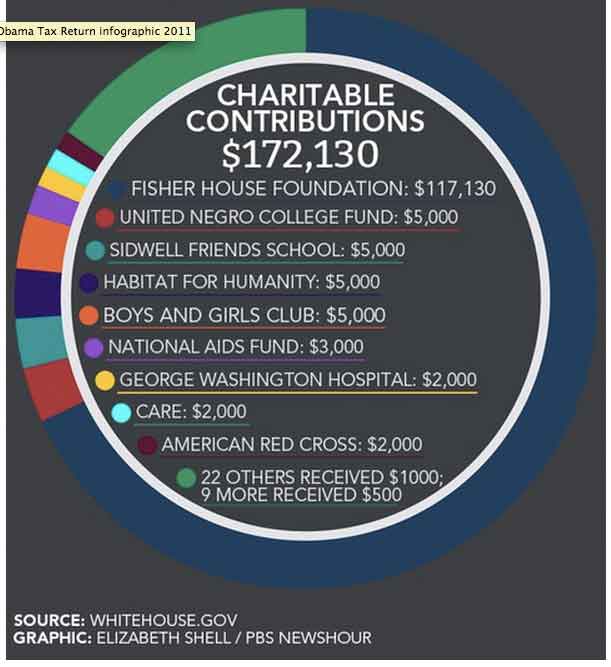

- They donated 22% of their adjusted gross income to charity ($172,130).

- The money was given to 39 different charities.

- The largest gift was a $117,130 contribution to the Fisher House Foundation. The President is donating the after-tax proceeds from his children’s book to Fisher House, a scholarship fund for children of fallen and disabled soldiers.

- For Illinois state income tax they paid $31,941.

The full return can be found at PBS NewsHour